Liabilities are debts or obligations a person or company owes to someone else. For example, a liability can be as simple as an I.O.U. to a friend or as big as a multibillion-dollar loan to purchase a tech company. In business, liabilities are building blocks of a company’s finances, often used to fund operations and expansions.

In this guide, we’ll go over:

- Liabilities Definition

- Types of Liabilities

- Liabilities Examples

- Liabilities vs. Assets

- Showing You Understand Liabilities on Resumes

Liabilities Definition

A liability is simply a debt or obligation. Most people have liabilities in their day-to-day lives: car payments, rent, and credit card bills. In corporate finance, the liabilities are similar, just on a much larger scale.

Liabilities for a business may be long-term loans for funding operations, money a company owes to vendors or suppliers, and leases on warehouse space. If a company has an obligation to pay someone or for something, it is a liability.

Who Deals With These Debts?

Liabilities are a core part of business and finance — business owners and members of a company’s financial team are responsible for understanding what liabilities their company has and how they affect the company as a whole.

Accountants also need a strong understanding of how these debts and obligations function within an organization’s finances. Accounting processes often involve examining the relationships between liabilities, assets, and equity and how these things affect a business’s profitability and performance.

Even in corporate finance, like investment banking and private equity, understanding the role of liabilities in a company’s financial structure is key to understanding a company’s financial position as a whole.

>>MORE: See the accounting skills you need on your resume.

Types of Liabilities

Liabilities are typically categorized by expiration or due date: current liabilities are pressing debts and obligations, while non-current liabilities are important but don’t require immediate action.

Current

Current liabilities are short-term debts and obligations due within one year. Some common examples of current liabilities are:

- Accounts payable: Money the company owes to lenders, clients, customers, and suppliers

- Short-term loans: Loans with repayment periods of one year or less

- Payments on long-term debt: Payments due on larger loans with repayment periods of more than one year, and the remainder of the loan owed is listed as a non-current liability

- Interest: Unpaid interest on loans

- Accrued liabilities: Any unpaid short-term debts from previous accounting periods

- Income taxes: Federal, state, and local income taxes that have not been paid yet

- Deferred revenue or unearned revenue: Money the company has received for goods or services it has not yet provided to the customer

- Commercial paper: Unsecured promissory notes with fixed interest rates used by companies to fund very pressing liabilities like payroll

Non-Current

Non-current or long-term liabilities are debts and obligations due in the future but not in the next year. Some types of non-current liabilities are:

- Bonds: A type of marketable security that has a specified maturity date (when payment is due in full) and interest rate

- Deferred tax: Federal, state, and local taxes owed, though not due immediately

- Long-term debt: Loans and other debts that are not due within the year, including remaining principal amounts on loans paid in increments

- Mortgages: Agreements with lenders that give the lender the right to repossess the purchased property if the loan is not repaid

- Leases: Payments for the use of another person’s property or assets, such as machinery, office spaces, and vehicles

- Pensions: Retirement funds for employees

Contingent Liabilities

Contingent liabilities are a special type of debt or obligation that may or may not happen in the future. These are contingent (or dependent on) certain events. The most common example of a contingent liability is legal costs related to the outcome of a lawsuit. For example, if the company wins the case and doesn’t need to pay any money, it does not need to cover the debt. However, if the company loses the lawsuit and needs to pay the other party, the company does need to cover the obligation.

Another example of a contingent liability is a warranty. If a company’s product requires repairs or replacement, the company needs the funds available to honor the warranty agreement.

Not every possible event can be planned for, though. So, when it comes to reporting a company’s finances, only certain contingent obligations need to be reported. According to the generally accepted accounting principles (GAAP), accountants only need to list probable liabilities on a company’s balance sheet. These are events that are very likely to happen, and the cost can be reasonably estimated.

The other two types of contingent liabilities — possible and remote — do not need to be stated in the balance sheet because they are less likely to occur and much harder to estimate. Accountants should note possible contingent liabilities in the footnotes of the company’s financial statements, though.

Liabilities Examples

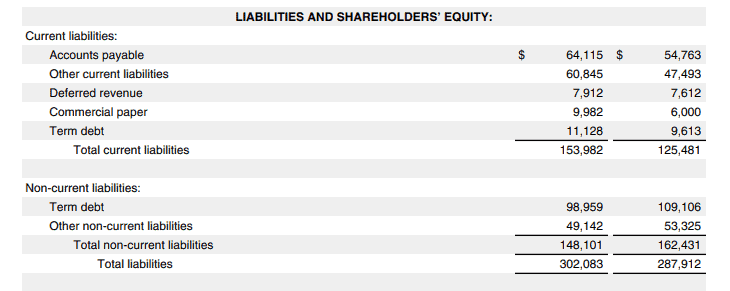

Using Apple’s balance sheet from 2022, we can see how companies detail current and non-current liabilities in financial statements.

Some companies may group certain liabilities under “other current/non-current liabilities” because they may not be common enough to warrant an entire line item. For example, if a company rarely uses short-term loans, it may group those with other current debts under an “other” category.

Liabilities vs. Assets

The flip side of liabilities is assets — resources the company uses to generate income. Assets include inventory, machinery, savings account balances, and intellectual property. Typically, gaining an asset means incurring a liability. For example, buying new equipment may mean taking out a loan to finance the purchase.

Assets and liabilities are two parts that make up a company’s finances. The third part is equity or money put into the company by founders or private investors. These three accounts, or aspects of a company’s finances, cover nearly every type of transaction or business decision a company can make. Additionally, accountants use a formula called the accounting equation based on assets, liabilities, and equity. This equation ensures accurate reporting of a company’s finances.

>>MORE: Learn more about assets.

Showing You Understand Liabilities on Resumes

Liabilities are a core part of accounting roles and many other careers in finance. The easiest way to show you understand them is by discussing skills you have in areas of accounting and finance that involve liabilities.

Some skills you can list in your resume’s skills section or the description of work or internship experiences include:

- Ensuring compliance with U.S. generally accepted accounting principles (GAAP)

- Creation and utilization of financial statements such as balance sheets

- Calculating financial health metrics like the current ratio and net working capital

Ready to learn new skills? Check out Forage’s free finance virtual experience programs.

Image credit: Canva