Understanding how to calculate profit margins is a core responsibility of accountants and many other finance professionals. Profit margins are an easy way to determine if a company is profitable and can inform investing decisions and help with crafting budgets.

In this guide, we’ll go over:

- What Is a Profit Margin?

- Profit Margin Formulas

- Calculating Profit Margins: Examples

- How to Show Profit Margin Knowledge on Your Resume

- Related Finance Skills

- FAQ

What Is a Profit Margin?

A profit margin is a straightforward measure of profitability. It looks at how much the company makes per $1 of revenue generated. Or, to put it another way, a profit margin shows how much revenue a company can keep as profit. Profit margins are typically expressed as percentages. For example, a 60% profit margin would mean a company had a profit of $0.60 for every dollar of revenue generated.

Profit margins can be negative or positive, and companies with negative profit margins can still survive. Ultimately, companies want to maximize profits, which they can do by either cutting expenses or by increasing revenue.

Who Needs to Calculate Profit Margins?

Calculating profit margins is a core aspect of many accounting roles and careers in finance. For example, investment bankers use profit margins to determine if a company is profitable and worth the investment. Understanding how to calculate profit margins can also help certain accountants, like certified management accountants, build budgets because they can see what areas are causing the most loss in profits.

Profit margins are ultimately useful for investors of any kind — profitable companies may be a less risky investment, and knowing a company’s profit margins can inform investing decisions.

>>MORE: Find out if a career in finance is right for you!

Profit Margin Formulas

You can calculate different types of profit margins, including net profit, gross profit, and operating profit. Gross profit looks at earnings after the cost of goods sold (COGS). On the other hand, net profit looks at profits after everything else has also been taken out, like taxes, marketing expenses, rent, and debts. Operating profit is how much money the company has left over after covering operating expenses (like COGS and employee wages), but before paying taxes and interest.

How to Calculate Gross Profit Margin

Gross profit is revenue (or net sales) minus the direct cost of goods or services. For example, if a company sells T-shirts, its gross profit would be how much it made from selling the shirts minus how much the company paid for the shirts. The margin is the gross profit divided by the total revenue, which creates a ratio. You can then multiply by 100 to make a percentage.

The formula for calculating gross profit margins is:

Gross Profit Margin = ( (Net Sales – COGS) / Revenue ) x 100

In this formula:

- Net sales can be used interchangeably with revenue for the sake of this formula — it is simply how much money was generated from selling products, goods, or services.

- COGS is the cost of goods sold (raw materials, labor, manufacturing expenses).

- Net sales minus COGS gives you gross profits.

- Multiply by 100 at the end of the formula to create a percentage.

How to Calculate Net Profit Margin

Net profit or net income is how much the company makes after all expenses are removed. These expenses include taxes, COGS, debts, operating costs, depreciation, and interest payments.

For example, the same T-shirt company from before also pays for warehouse space, advertisements, and small business loan payments. So, the net profit would be how much is left over after all of that is covered. To find the net profit margin, you divide the net income by total revenue, creating a ratio. You can then multiply by 100 to make a percentage.

The formula for calculating net profit margins is:

Net Profit Margin = (Net Profit / Revenue) x 100

In this formula:

- Net profit is the same as net income: the amount left over after all costs are accounted for.

- Revenue is how much money was generated by the company by selling products, goods, or services.

- Multiply by 100 to create a percentage.

How to Calculate Operating Profit Margin

Operating profit (or operating income) is a company’s revenue after covering operating expenses, like COGS, employee wages, depreciation, and amortization. However, operating profits are pre-tax and pre-interest, meaning it’s the revenue available before a company pays its income and property taxes and interest payments.

Think of operating profit as a step between gross profit and net profit — for gross profit, only COGS is subtracted from revenue, and for net profits, all expenses are subtracted, including taxes and interest. Operating profit is useful to know because you can use it to compare companies in states that may have different tax rates. You can also use it to determine if a company is managing operating expenses effectively.

The formula for calculating operating profit margins is:

Operating Profit Margin = (Operating Profit / Revenue) x 100

In this formula:

- Operating profit is the remaining revenue after subtracting operating expenses.

- Revenue is profits generated from the sale of goods, products, and services.

- Multiply by 100 to create a percentage.

Chartered Accountants ANZ Accounting and Business Performance

Explore how profit margins and other financial metrics work in real business settings with this free job simulation.

Avg. Time: 3 to 4.5 hours

Skills you’ll build: Profits and loss, competitor analysis, pricing structures, business models, research, presentations

Calculating Profit Margins: Examples

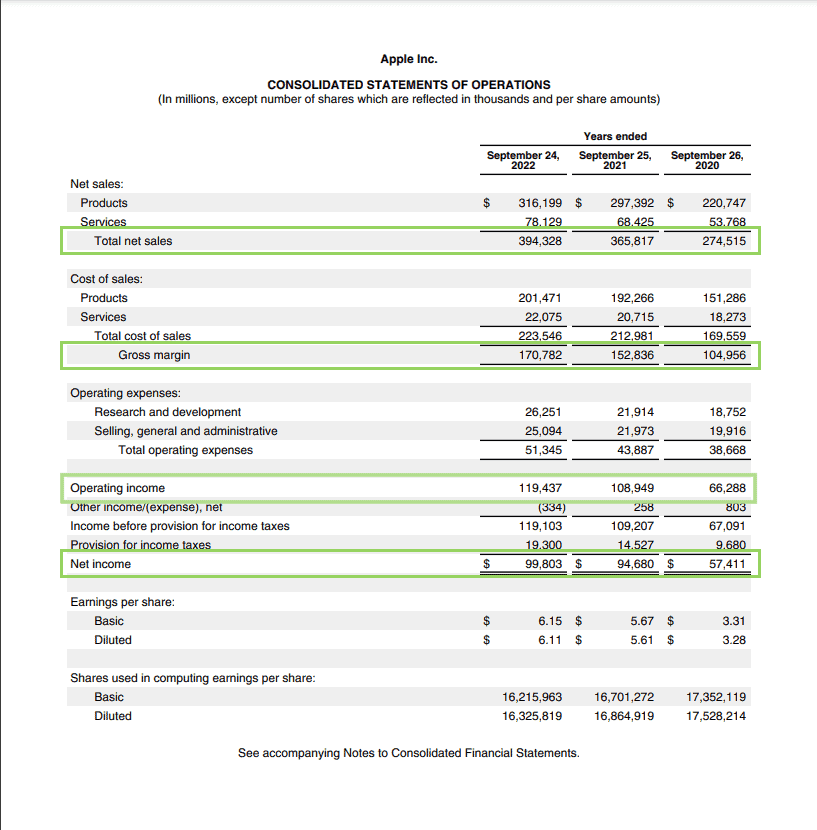

Let’s take a look at Apple. Using Apple’s 2022 earnings statement, we can figure out its profit margins for 2022.

From Apple’s consolidated statement of operations, we can see the following details:

- Apple’s total net sales (revenue) for 2022: $394,328 million

- Apple’s gross profit for 2022: $170,782 million

- Apple’s net income (profit) for 2022: $99,803 million

- Apple’s operating income (operating profit) for 2022: $119,437 million

To determine the gross profit margin, we need to divide the gross profit by the total revenue for the year and then multiply by 100.

( $170,782m / $394,328m ) x 100

- Apple’s gross profit margin for 2022 is: 43.3%

To determine the net profit margin, we need to divide the net income (or net profit) by the total revenue for the year and then multiply by 100.

( $99,803m / $394,328m ) x 100

- Apple’s net profit margin for 2022 is: 25.3%

To determine the operating profit margin, we need to divide the operating income or operating profit by the company’s total revenue and then multiply by 100.

( $119,437m / $394,328m ) x 100

- Apple’s operating profit margin for 2022 is: 30.3%

>>MORE: Explore more accounting skills you need for your resume.

How to Show Profit Margin Knowledge on Your Resume

You should mention on your resume if you have coursework, past work experience, or internships that dealt with business valuation methods or tracking companies’ profitability since these skills imply an understanding of profit margins. You can also mention profit margins directly. For instance, in the description of a job or internship, you could say you “calculated profit margins for a company worth $X amount” or that you calculated and compared profit margins for companies across various industries.

You can also talk about your experience with profit margins in your cover letter. For example, you can mention if your relative has a small business and you helped them look at their profit margins to find areas where cutting costs would have a big impact.

>>MORE: See other ways to showcase your hard skills.

Related Finance Skills

Calculating profit margins is only one way to determine a company’s profitability. Accountants and finance professionals need to understand other ways to measure a business’s success, such as:

- Determining contribution margins for goods, products, and services

- Calculating compound annual growth rate (CAGR)

- Using business valuation approaches, such as discounted cash flow (DCF) analysis

- Performing comparable company analysis

- Measuring internal rates of return

Start learning these skills today with Forage’s free accounting job simulations.

FAQ

You can calculate profit margins backward to determine how much to charge for a single product or how much revenue you’ll need to make to offset your expenses.

Let’s say you want a 20% profit margin on sales for your T-shirt company. The T-shirts cost you $5 to make. To figure out how much to charge per shirt, turn the 20% into a decimal by dividing it by 100: 0.20. Then, subtract 0.20 from 1 to get 0.80 — this is the other 80% of the revenue that you will offset with the cost of the product. Divide your cost to make a shirt (5.00) by 0.80 to determine how much to charge per shirt to guarantee a 20% profit margin.

5.00/0.80 = $6.25

What counts as a “good” profit margin depends largely on the company and industry. In general, a 5% profit margin is considered fairly low — the product is expensive to produce and doesn’t generate much revenue.

Finance professionals typically consider 10% profit margins healthy or average — this margin ensures profits, but you likely aren’t over-pricing your product.

A 20% margin is high, which can be great for many companies, but high profits mean you’re selling the product for significantly more than it costs to produce. This may not be sustainable as, among other things, consumers may eventually try to find a cheaper option.

A product’s markup is the difference between its cost price and sales price. For example, if you buy keychains wholesale for $1 each, selling each keychain for $5 is a $4 markup.

A product’s profit margin can be equal to its markup. However, some profit margin formulas take into account peripheral expenses, like employee wages and transportation costs, which a product’s markup may not reflect.

Profit margins tell you how much a company makes from selling goods and services after covering direct and indirect costs. Profit margins are percentages that measure profitability — higher percentages mean higher profits.

Image credit: IgorVetushko / Depositphotos.com