NPV, or net present value, is how much an investment is worth throughout its lifetime, discounted to today’s value. The NPV formula is often used in investment banking and accounting to determine if an investment, project, or business will be profitable in the long run.

What Is NPV?

Net present value is used to determine whether or not an investment, project, or business will be profitable down the line. The NPV of an investment is the sum of all future cash flows over the investment’s lifetime, discounted to the present value.

Companies often use net present value in budgeting to decide how and where to allocate capital. By adjusting each investment option or potential project to the same level — how much it will be worth in the end — finance professionals are better equipped to make informed decisions.

To calculate NPV, you have to start with a discounted cash flow (DCF) valuation because net present value is the end result of a DCF calculation.

JPMorgan Investment Banking

See if you have what it takes to make it in investment banking and learn how to perform DCF analyses with this free job simulation from JPMorgan.

Avg. Time: 5 hours

Skills you’ll build: M&A screening, company analysis, strategic rationale, financial modeling, DCF analysis, presentations, client communication

Who Uses Net Present Value?

Corporate finance professionals commonly use net present value. For example, investment bankers compare net present values to determine which merger or acquisition is worth the investment. Additionally, some accountants, such as certified management accountants, may rely on NPV when handling budgets and prioritizing projects.

Business owners can also benefit from understanding how to calculate NPV to help with budgeting decisions and to have a clearer view of their business’s value in the future.

NPV Formula

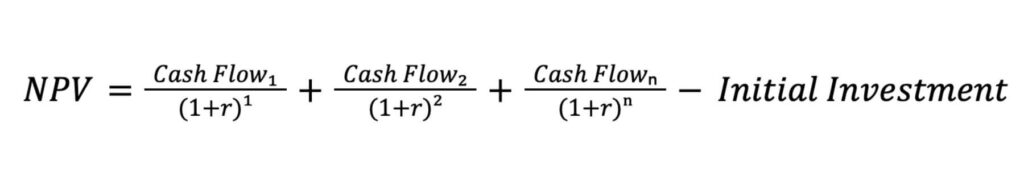

To calculate net present value, you need to determine the cash flows for each period of the investment or project, discount them to present value, and subtract the initial investment from the sum of the project’s discounted cash flows.

The NPV formula is:

In this formula:

- Cash Flow is the sum of money spent and earned on the investment or project for a given period of time.

- n is the number of periods of time.

- r is the discount rate.

Components of NPV

Cash Flow

Cash flows are any money spent or earned for the sake of the investment, including things like capital expenditures, interest, and loan payments. Each period’s cash flow includes both outflows for expenses and inflows for profits, revenue, or dividends.

Number of Periods (n)

The number of periods equals how many months or years the project or investment will last. Sometimes, the number of periods will default to 10, or 10 years, since that’s the average lifespan of a business. However, different projects, companies, and investments may have more specific timeframes.

Discount Rate (r)

In most situations, the discount rate is the company’s weighted average cost of capital (WACC). A company’s WACC is how much money it needs to make to justify the cost of operating. WACC includes the company’s interest rate, loan payments, and dividend payments.

Cash flows need to be discounted because of a concept called the time value of money. This is the belief that money today is worth more than money received at a later date. For example, $10 today is worth more than $10 a year from now because you can invest the money received now to earn interest over that year. Additionally, interest rates and inflation affect how much $1 is worth, so discounting future cash flows to the present value allows us to analyze and compare investment options more accurately.

Initial Investment

The initial investment is how much the project or investment costs upfront. For example, if a project initially costs $5 million, that will be subtracted from the total discounted cash flows.

Bank of America Investment Banking

Explore calculating NPV in a real-world setting with this free job simulation from Bank of America.

Avg. Time: 5 hours

Skills you’ll build: SWOT analysis, financial analysis, M&A screening, ECM, DCM, DCF, valuation, communication, presentations, business development

Interpreting Net Present Value

Net present value has three potential outcomes:

- Positive NPV: A positive dollar amount means the project or investment may be profitable and worth pursuing.

- Negative NPV: A negative dollar amount means the project or investment is unlikely to be profitable and should probably not be pursued.

- Zero NPV: A net present value of zero means the project or investment is neither profitable nor costly. A company may still consider projects and investments with an NPV of zero if the project has significant intangible benefits, such as strategic positioning, brand equity, or increased consumer satisfaction.

Net Present Value Example

Let’s assume your company has two potential projects it can start. How can we decide which project is the better option?

Your company’s weighted average cost of capital is 7%, so 7% will be the discount rate for both projects. Each project lasts five years. The initial investment and cash flows for the two projects are:

Project A

- Initial investment: $15 million

- Cash Flow Year 1: $3 million

- Cash Flow Year 2: $3 million

- Cash Flow Year 3: $5 million

- Cash Flow Year 4: $5 million

- Cash Flow Year 5: $5 million

Project B

- Initial investment: $20 million

- Cash Flow Year 1: $2 million

- Cash Flow Year 2: $4 million

- Cash Flow Year 3: $6 million

- Cash Flow Year 4: $8 million

- Cash Flow Year 5: $10 million

Discounting these cash flows using the 7% weighted average cost of capital, the annual discounted cash flows for each project are:

| Year | Project A | Project B |

| 1 | $2,803,738 | $1,869,159 |

| 2 | $2,620,316 | $3,493,755 |

| 3 | $4,081,489 | $4,897,787 |

| 4 | $3,814,476 | $6,103,162 |

| 5 | $3,564,931 | $7,129,862 |

| Cash Flow Sum | $16,884,950 | $23,493,725 |

Once we have the total of the discounted cash flows for the duration of the project, we can find the net present value for each by subtracting the initial investment:

Project A’s NPV = $16,884,950 – $15,000,000

NPV = $1,884,950

Project B’s NPV = $23,493,725 – $20,000,000

NPV = $3,493,725

Either project will be profitable. At face value, Project B looks better because it has a higher NPV, meaning it’s more profitable. However, it’s important to consider other factors. For example, is the net present value of Project B high enough to warrant a bigger initial investment? Financial professionals also consider intangible benefits, such as strategic positioning and brand equity, to determine which project is a better investment.

Pro Tip: When financial professionals calculate NPV, Excel can be leveraged to make it a fast and simple process. Although you can determine net present value by hand with a calculator, most professionals rely on Excel or pre-made NPV calculators.

JPMorgan Excel Skills

Learn the fundamental Excel skills you need to succeed with this free simulation from JPMorgan.

Avg. Time: 5.5 to 7.5 hours

Skills you’ll build: Excel shortcuts, conditional formatting, data exploration, VBA Macros, data visualization, written communication

Net Present Value Drawbacks

A positive NPV does not describe the initial investment cost and is typically not enough to determine if an investment is worthwhile. For example, let’s say one project has an NPV of $15 and another has an NPV of $200. Although the $200 project seems more worthwhile, it’s difficult to make a decision without reviewing the initial investments. What if the initial investment for the $15 project was only $1, and the initial investment for the $200 project was $150?

Another flaw with relying on net present value is that the formula uses estimates. Especially with long-term investments, these estimates may not always be accurate. Additionally, the formula doesn’t account for external benefits from certain investments or projects — intangible benefits, like relationship building or a positive public image, may not be recorded on a balance sheet, but that doesn’t mean they’re not valuable.

Showcase new skills

Build the confidence and practical skills that employers are looking for with Forage’s free job simulations.

Showing NPV Calculation Skills on Your Resume

Calculating and interpreting NPV for projects, investments, and businesses is one part of two broad skill categories: financial modeling and business valuation. On your resume, you can include NPV as an example of your skills in either category.

Additionally, if you have prior work or internship experience using NPV, mention that in the description of the job or internship. For example, you can describe a project involving calculating and comparing the net present value of five investment options as an intern with Goldman Sachs.

If you don’t have any relevant internship or work experience, your cover letter is a great place to show off your hard skills. In your cover letter, you can:

- Discuss any personal experiences using financial modeling or business valuation tactics.

- Talk about a time you helped a friend calculate the net present value of an investment they were considering.

- Describe when you helped a family member determine the value of their small business.

- Explain coursework or personal study that exposed you to business valuation or financial modeling.

>>MORE: Learn if finance is a good career path for you.

Related Finance Skills

Understanding how to calculate and interpret net present value is a core skill for many careers in finance. Other crucial skills for finance professionals include:

- Calculating the weighted average cost of capital (WACC)

- Understanding the uses and limitations of EBITDA (earnings before interest, taxes, depreciation, and amortization)

- Having a familiarity with corporate finance concepts, like stock options

- Knowing how to complete a comparable company analysis

Explore these skills and more with Forage’s free banking and financial services job simulations.

Image credit: Canva